Invest Beyond the Public Markets

Total Investment

-

$2,000,000

Industry

-

CPA

Investment Type

-

Equity

Total Investment

-

N/A

Industry

-

Private Equity

Investment Type

-

Equity

Total Investment

-

< $1,000,000

Industry

-

Architectural Services

Investment Type

-

Equity

Current Stage

-

Under LOI

Industry

-

Engineering & Manufacturing

Investment Type

-

Equity

Current Stage

-

Analyzing

Industry

-

Manufacturing

Investment Type

-

Equity

Current Stage

-

Analyzing

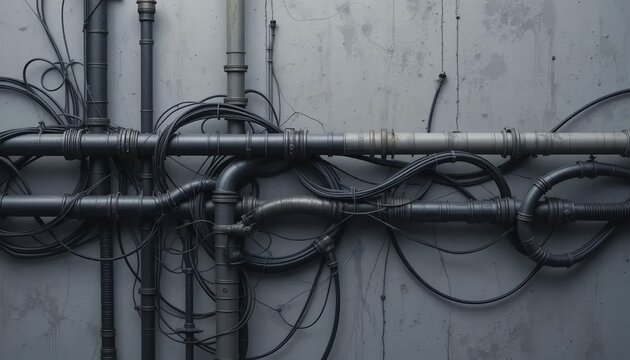

Industry

-

Industrial Infrastructure Protection

Investment Type

-

Equity

Current Stage

-

Under LOI

Industry

-

Design & Wayfinding

Investment Type

-

Equity

Total Investment

-

< $1,000,000

Industry

-

Architecture

Investment Type

-

Equity

Total Investment

-

$2,000,000 - $5,000,000

Industry

-

Pet Services

Investment Type

-

Equity

Total Investment

-

$2,000,000 - $5,000,000

Industry

-

HVAC Services

Investment Type

-

Equity

Total Investment

-

$2,000,000 - $5,000,000

Industry

-

Manufacturing

Investment Type

-

Equity

Total Investment

-

< $1,000,000

Industry

-

Real Estate

Investment Type

-

Equity

Total Investment

-

< $1,000,000

Industry

-

Manufacturing

Investment Type

-

Equity

Total Investment

-

< $1,000,000

Industry

-

Industrial Services

Investment Type

-

Equity